Rate Borang E Filing Lhdn Form as 5 stars Rate Borang E Filing Lhdn Form as 4 stars Rate Borang E Filing Lhdn Form as 3 stars Rate Borang E Filing Lhdn Form as 2 stars Rate Borang E Filing Lhdn Form as 1 stars. 03-89111000 603-89111100 Overseas 2019 YEAR OF ASSESSMENTForm Amend.

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

2019 B LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF AN INDIVIDUAL RESIDENT WHO CARRIES ON BUSINESS.

. Form e submission deadline 2019. EA Form in Excel Download. Form e submission deadline 2020.

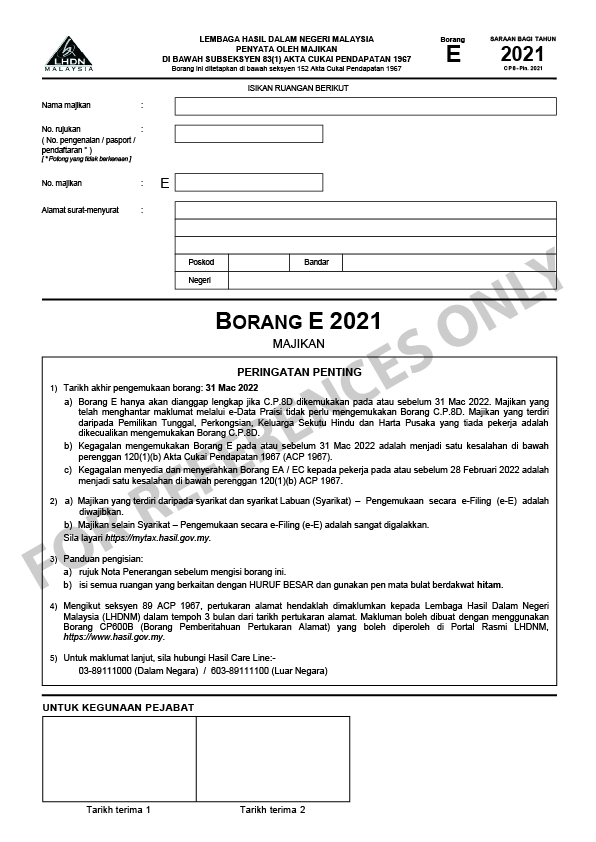

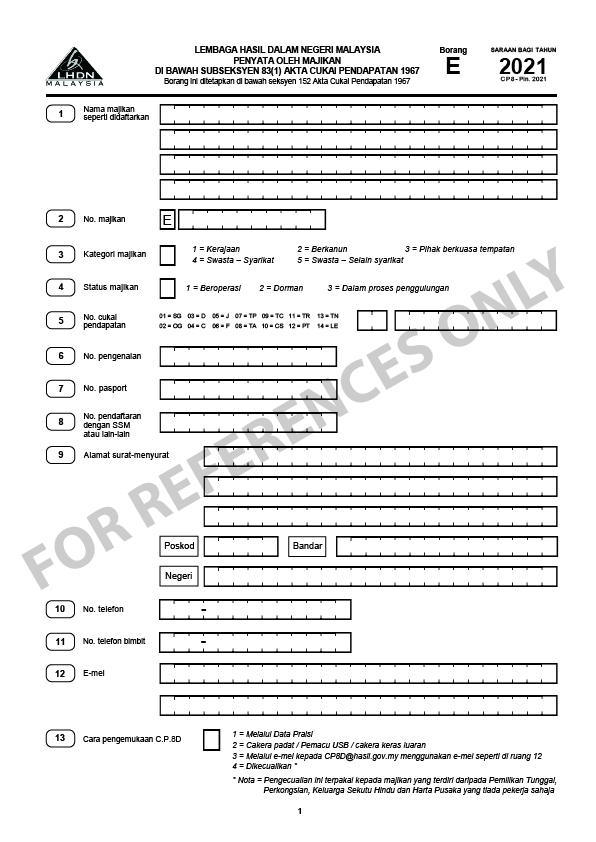

B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2020 adalah menjadi satu kesalahan di bawah. Please access via httpsezhasilgovmy. Borang E contains information like the company particulars and details of every employees earnings in the company.

Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. Due date to furnish Form E for the Year of Remuneration 2019 is 31 March 2020. Failure to submit the Form E on or before 31 March 2020 is a criminal offense and can be prosecuted in court.

BORANG E 2019 Nama majikan. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. 31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020.

Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut. 700 malam hingga 700 pagi. Poskod Bandar UT 019 CP8 - Pin.

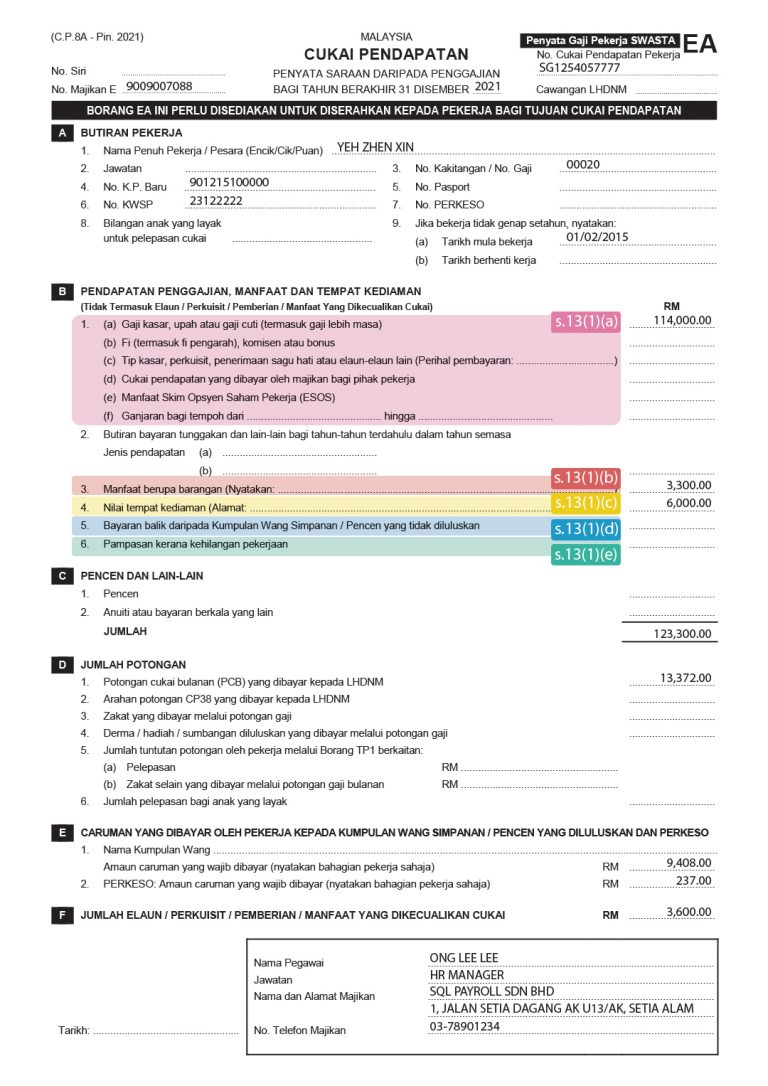

RETURN OF REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION. As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. 4 a Employers which are companies and Labuan companies Companies -The use of e filing e E is mandatory.

1 Tarikh akhir pengemukaan borang. 2019 Borang SARAAN BAG I TAHUN E LEMBAGA HASIL DALAM NEGERI MALAYSIA PENYATA OLEH MAJIKAN CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967. Form E is an employee income declaration report that employers have to submit every year.

The earnings that are to be included in CP8D form should be shown in. Pengenalan pasport pendaftaran Potong yang tidak berkenaan. B Employers other than Companies - The use of e-filing is encouraged.

How to submit form e online. Please access via httpsezhasilgovmy. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

02 April 2020 Khamis hingga 03 April 2020 Jumaat. For further information please contact Hasil Care Line-Hotline. EA Form in PDF Download.

Section 83 1A Income Tax Act 1967. The Borang E must be submitted by the 31st of march of every year. 5 For further information please contact Hasil Care Line-Hotline.

7 The use of e-Filing e-B is encouraged. 03-89111000 603-89111100 Overseas FORM E 2019. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Understanding Lhdn Form Ea Form E And Form Cp8d

2018 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Borang E Archives Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Understanding Lhdn Form Ea Form E And Form Cp8d

11 Delivery Order Templates Word Excel Pdf Templates Word Template Templates Templates Printable Free

What Is Form E What Is Cp8d What Is E Filling Sql Otosection

Understanding Lhdn Form Ea Form E And Form Cp8d

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Edayu Co Chartered Accountant Reminder For Prepare Form E It Is Time To Start Preparing The Form E Employer S Responsibilities If You Have An Employee During Last Year

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection